Bali Travel Requirements 2026: Complete Guide for Visas, Entry Rules & Tourist Tax

January 27, 2026

Digital Nomad Visa Bali (E33G) 2025: Complete Guide for Remote Workers

January 30, 2026

Bali Travel Requirements 2026: Complete Guide for Visas, Entry Rules & Tourist Tax

January 27, 2026

Digital Nomad Visa Bali (E33G) 2025: Complete Guide for Remote Workers

January 30, 2026What is BPJS? Complete Guide for Indonesians, Expats, and Employers

Published by Made Widiartha on January 29, 2026

Table of contents

- What is BPJS? Complete Guide for Indonesians, Expats, and Employers

- Published by Made Widiartha on January 29, 2026

- What is BPJS? Clear Definition in Simple Terms

- Who Must Join BPJS in Indonesia? (Indonesians, Expats, and Employers)

- Foreigners and Expats Living in Indonesia

- BPJS for Expats in Indonesia, Including Bali: Complete Guide

- Why Expats Should Care About BPJS

- Eligibility Requirements for Foreigners

- BPJS or Private Insurance, Which Is Better for Expats?

- For many long term expats in Bali, a combined approach works well: BPJS for basic coverage and local compliance, plus private international insurance for comfort, faster access, and overseas care.

- Step by Step: How to Register for BPJS (Employees, Freelancers, and Expats)

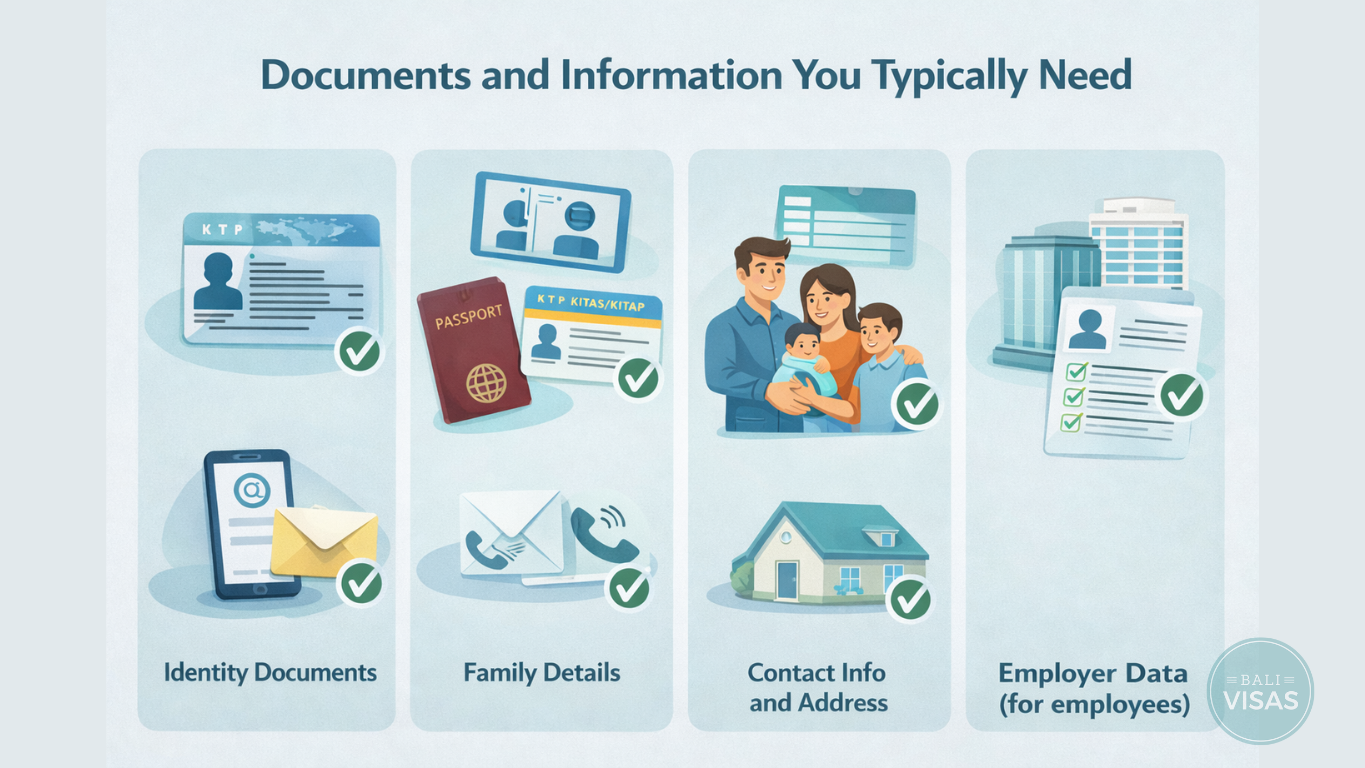

- Documents and Information You Typically Need

- SOURCE :

- Made Widiartha

- Need a Visa or Got More Questions?

If you’ve just moved to Indonesia, started a job here, or you’re hiring staff locally, you’ll hear one term a lot: BPJS.

So, what is BPJS? In simple terms, BPJS is Indonesia’s national social security system. It covers two big areas: Healthcare & Employment-related protection.

This guide is for Indonesians, expats, and employers who want straightforward answers. Especially foreigners who often ask: Do I need BPJS? Which one? How do I register? How much does it cost?

Let’s go through it all!

What is BPJS? Clear Definition in Simple Terms

-

BPJS stands for Badan Penyelenggara Jaminan Sosial.

In everyday terms, it’s Indonesia’s official system that helps make sure people have basic protection for healthcare and work-related risks, so you’re not left handling everything alone when you get sick, have an accident, or face certain life events.

Most confusion comes from the fact that people say “BPJS” as one thing, but it actually covers these two different areas as explained below

- BPJS Kesehatan : Indonesia’s national health insurance administrator (this is the one tied to healthcare access).

- BPJS Ketenagakerjaan : Indonesia’s employment social security administrator (this is the one related to worker protection and benefits).

So why did Indonesia create BPJS in the first place?

The idea is simple: wider and more universal coverage and stronger protection for individuals who qualify, especially workers and families.

So social security isn’t only for a small group, but can support the broader population.

Who Must Join BPJS in Indonesia? (Indonesians, Expats, and Employers)

If you are living in Indonesia, working here, or employing staff here, BPJS is not just “nice to have.”

In many cases, it is a legal requirement, especially for health coverage under the national program.

Indonesian Citizens and Residents

In general, all residents of Indonesia are required to be enrolled in the national health insurance program (JKN) managed by BPJS Kesehatan.

There are two common participant categories you will hear about:

- PBI (Penerima Bantuan Iuran)

This is for poor and vulnerable groups where the Government pays the contribution on their behalf. - Regular participants who pay monthly contributions

This includes people who pay independently, and also employees whose contributions are handled through payroll depending on their employment status and arrangement.

Foreigners and Expats Living in Indonesia

This is the part many expats ask about: “Do I really need BPJS?”

Under Indonesia’s BPJS law and BPJS Kesehatan guidance, foreigners who work in Indonesia for at least 6 months are required to become participants.

In practice, foreigners who usually fall into this category include:

- Longer stay expats, such as KITAS or KITAP holders who live in Indonesia and are working

- Foreign employees working for Indonesian registered companies, because employers have registration obligations for their workers

Okay, how about tourists or short term visitors?

BPJS rules focus on residents and foreign workers. If you are visiting Indonesia short term and not employed here, BPJS is typically not the target system, so most travelers rely on travel insurance or private insurance instead.

Employer Responsibilities and Compliance

If you run a company in Indonesia or hire employees locally, your responsibilities are very clear.

Employers must:

- Register the company and employees with BPJS according to the social security programs they join

- Provide complete and accurate employee data, including required family data where applicable

- Pay contributions on time, because non compliance can lead to penalties

If employers do not comply, Indonesia has administrative sanctions that can include written warnings, fines, and even denial of certain public services.

These can affect business related licensing and permits, including permits to employ foreign workers.

BPJS for Expats in Indonesia, Including Bali: Complete Guide

Living in Bali can feel simple day to day, until you need medical care, have an accident, or deal with paperwork for work and residency.

That is where BPJS becomes more than just a local term you hear, it becomes something you need to understand.

Why Expats Should Care About BPJS

If you rely only on paying out of pocket, private healthcare can get expensive quickly, especially for emergency care, hospital stays, scans, or surgery. Even when you plan to use private hospitals, emergencies rarely wait for you to compare prices or call an insurer first.

For many long stay expats, BPJS is best seen as a solid foundation.

- It helps you stay aligned with local expectations for health coverage when you live and work in Indonesia.

- It gives you access to a broad network, including referral based care within the national system.

- It can reduce the financial shock when something unexpected happens.

At the same time, many expats still choose to keep private international insurance for extra comfort.

- More choice of private hospitals and specialists

- Faster access for certain services

- Coverage for treatment outside Indonesia, depending on the plan

In other words, BPJS can cover the basics, while private insurance can cover your preferred experience.

Eligibility Requirements for Foreigners

Most expats who successfully register for BPJS typically fall into one of these situations.

- You hold a valid long stay permit, such as KITAS or KITAP

- You are employed by an Indonesian registered company, which can register you through payroll and HR processes

- Your civil data is properly recorded for administration purposes, which may include having a NIK and being registered with Dukcapil, depending on your situation and local processing requirements

If you are unsure, a good practical question to ask is this: are you a resident and worker here, or are you visiting short term. BPJS is generally designed around residents and formal participation, not short holidays.

BPJS or Private Insurance, Which Is Better for Expats?

There is no single best answer for everyone, but here is a clear way to think about it.

BPJS can be a good fit if you want

- A legally aligned baseline for long stay life in Indonesia

- Affordable monthly contributions compared with many private plans

- Access to the national referral system and participating facilities

BPJS may feel limited if you expect

- Direct access to specialists without referrals

- A fully private hospital experience every time

- International coverage outside Indonesia

Private international insurance can be a good fit if you want

- Comfort and convenience at private hospitals

- More flexibility in provider choice

- Overseas coverage, depending on the plan

Private insurance can be challenging because

- Premiums can be significantly higher

- Pre existing condition rules and exclusions may apply

- Claims processes can vary by provider

For many long term expats in Bali, a combined approach works well: BPJS for basic coverage and local compliance, plus private international insurance for comfort, faster access, and overseas care.

Step by Step: How to Register for BPJS (Employees, Freelancers, and Expats)

The registration route depends on your situation. If you are employed, your employer usually handles it.

BPJS via Employer (Most Common Scenario)

If you work for an Indonesia registered company, this is the most common and usually the easiest path, because employers are required to register workers and submit accurate worker data.

Here is how it typically works:

- Your employer collects your data This usually includes your identity details, family details if applicable, and salary information for contribution calculation.

- Your employer registers you with BPJS Kesehatan and BPJS Ketenagakerjaan For BPJS Ketenagakerjaan, the employer side registration process is commonly handled by HR or the appointed company PIC through the official BPJS Ketenagakerjaan channels. For BPJS Kesehatan, many companies use employer admin tools such as the eDabu portal for employee data management and registration workflows.

- Contributions are paid through payroll In most employee setups, the company pays its share and deducts the employee share from salary, then pays the total to BPJS according to the schedule.

- Timing expectations Registration is typically expected soon after you start, so you do not end up uninsured, inactive, or stuck when you need care or administrative proof of coverage.

Practical tip for expats: if you are on a work KITAS and employed, ask your HR team early,

“Am I already registered in BPJS Kesehatan and BPJS Ketenagakerjaan, and when will my membership number be issued?”

Self Registration for BPJS Kesehatan (Self Employed and Informal Workers)

If you are not registered through an employer, you may be able to register yourself for BPJS Kesehatan.

A common route is Mobile JKN, which provides a “new participant registration” flow.

The steps usually look like this:

- Prepare your basic documents and contact details For Indonesians, this often centers around your family card and population data.

- Register via Mobile JKN or visit a BPJS office or service partner Mobile JKN provides an in app registration process for new participants.

- Choose your participation options and complete payment for the first contribution If the current structure still requires selecting a service class or equivalent option, you will choose it during registration, then pay the first contribution to activate coverage.

Note for foreigners: many expats register through the employer route. Self registration availability and required civil data can vary depending on your stay permit and how your data is recorded locally, so if you are not employed, it is smart to confirm the latest requirements directly with BPJS before you assume self registration will work smoothly.

Documents and Information You Typically Need

Here is a practical checklist of what is commonly requested.

For Indonesian citizens:

• KTP

• Family Card and family member details

• Address and contact number

• Email, if you are registering through an app or online portal

For expats:

• Passport

• KITAS or KITAP

• Address and contact number in Indonesia

• Family details if registering dependents through your employer

For employees:

• Employer details submitted by HR

• Salary information for contribution calculation

• Up to date personal data, because employers are required to submit accurate worker data to BPJS

If you share the next topic, I can continue with the same tone and also add a short “common mistakes to avoid” box, which is very helpful for expats and HR teams.

SOURCE :

Article by :

Made Widiartha

I Made Widiartha is a recognized agent at Bali Visas (balivisas.com), a prominent, ISO-certified visa agency in Bali with over 20 years of experience. Clients have highlighted Widiartha for providing excellent service, specifically mentioning fast, responsive, and reliable assistance with visa applications and extensions.

Need a Visa or Got More Questions?